Introduction

1 About our Payment Assistance Policy

In Australia, telco customers who are in financial difficulty may be entitled to assistance from their telco supplier. This Payment Assistance Policy (policy, for short) explains:

- when you may be eligible for financial hardship assistance;

- what assistance we can provide;

- how you can contact us to talk about assistance and apply for it;

- how we process and manage applications for assistance;

- other options for getting support; and

- other important matters

2 The goals of our policy

For customers experiencing financial hardship:

- the goal of our policy is to keep you connected; and

- We will only use disconnection as a measure of the last resort

3 You are entitled to apply for assistance, free of charge

- You have a right to apply for financial hardship assistance. The outcome of your application will be in accordance with this policy and the laws that apply to it.

- Using this policy, including making an application, is free of charge.

4 You can complain about our decision

- You can complain to us about our decision on your application, including asking for a review. You can access our Complaint Handling Process here. It explains in detail how to make a complaint, and how we process complaints.

- If you’re still not happy, you can make a complaint to the Telecommunications Industry Ombudsman (TIO):

- at the TIO website: tio.com.au

- by phone 1800 062 058

- by email [email protected]

- by fax 1800 630 614

- by post PO Box 276, Collins Street West, VIC 8007

- Making a complaint as set out above does not prevent you from agreeing to an arrangement with us for financial hardship assistance.

5 Other places to get help

You can also get information and advice from:

- the TIO – details above; and

- financial counselling services. To find and contact a financial counseling service that’s available and suitable for you, visit the Australian Government information page at moneysmart.gov.au/managing-debt/financial-counselling

6 Contacting authorised personnel

You can contact us to speak directly with personnel who are authorised to deal with applications for financial hardship assistance:

- by calling 1300 880 663 during the following days and hours: Monday – Friday 08:00 to 20:00 Australian Eastern Standard Time (AEST);

- by EMAIL to [email protected].

7 Do you have special communications needs?

Do you need a spoken language interpreter?

If you need a spoken language interpreter, you can call the Australian Government’s Translating and Interpreting Service on 131 450.

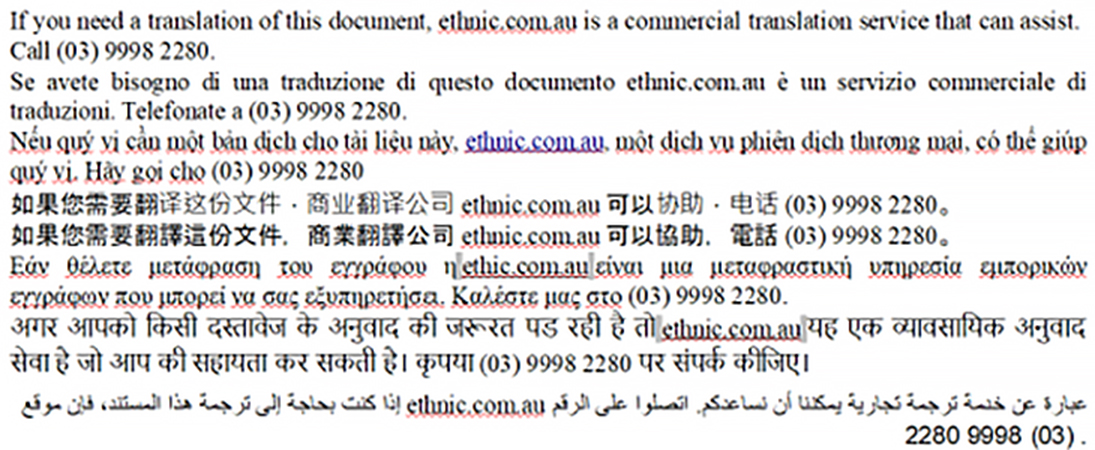

Do you need a written language interpreter?

Do you need the National Relay Service?

If you are deaf, hard of hearing, or have a speech impairment, you can also contact us through the National Relay Service (NRS) on 1800 555 677.

Eligibility for financial hardship assistance, and our application form

8 Legal test for eligibility

There is a legal test for eligibility to receive financial hardship assistance. To make it as simple as possible to understand, we have built the legal test into Part 2 of our application form, in plain English.

9 Understanding if you are eligible

Part 2 of our application form contains a number of statements. Each is followed by a coloured tick box e.g.:

There are tick boxes in grey and orange and green and blue and pink and yellow. If you have ticked:

- at least one grey box, and

- the orange box, and

- the green box, and

- at least one blue box, and

- at least one pink box, and

- the yellow box –

then you may be eligible for financial hardship assistance.

Options for assistance

10 Financial hardship assistance

The options we offer for financial hardship assistance are indicated by the pink check boxes on our application form.

11 General assistance

By way of general assistance to customers to manage payment obligations and associated debts, to us, we will consider payment plans where reasonably requested, unless we assess that there is unacceptable credit risk or that payments will not be brought up to date within two billing cycles.

How to apply for financial hardship assistance

12 Step 1: Fill in an application form

-

- The form is:

- available on the same web page or location where we keep our payment assistance policy; and

- included in our payment assistance policy – and we’ll send you a copy on request.

- Complete Part 1 of the application by filling in the details requested

- Complete Part 2 of the application by:

- reading each statement in Part 2; and

- for each statement that is correct, ticking its box

- Complete Part 3 of the application by explaining the financial hardship assistance you (This is optional, but this information may speed up the process.)

- Complete Part 4 of the application by explaining any special matters you’d like us to be aware (This is optional, but this information may help us to help you more safely and sensitively.)

- Sign the application where indicated

- The form is:

13 Step 2: Send the application to us

You can do that by:

- posting it to Orion Satellite Systems, Level 2, 16 Victoria Avenue, Perth WA 6000;

- emailing it to [email protected];

- giving us the application details by phone, by calling 1300 880 663.

Assessing your eligibility for financial hardship assistance

14 Step 3: We’ll acknowledge your application

We’ll notify you:

- that we have received your application;

- of a reference number that identifies your application; and

- of our estimated time to complete the assessment of your application

15 Step 4: We’ll let you know if we need evidence (information, including documents) to show that you are in financial hardship

- We’ll only do this if the evidence is relevant to your application and not unreasonably onerous.

- If you have applied for assistance for three billing cycles or less, we won’t ask for such evidence (and you are not required to provide it) unless:

- it appears that an assistance arrangement will need to be for more than three billing periods; and

- any of the following applies:

- the amount to be repaid is more than $1,000;

- you have been our customer for less than two months; or

- we reasonably believe there is a possibility of fraud; and

- the evidence is strictly necessary to assess your eligibility for financial hardship assistance.

- If it appears that you may be a victim survivor of domestic or family violence, we won’t ask for such evidence (and you are not required to provide it) unless:

- it appears that an assistance arrangement will need to be for more than three billing periods; and

- any of the following applies:

- the amount to be repaid is more than $1,000;

- you have been our customer for less than two months; or

- we reasonably believe there is a possibility of fraud; and

- the evidence is strictly necessary to assess your eligibility for financial hardship assistance.

- Subject to paragraphs (b) and (c) above, the types of evidence you may be required to provide to support that you are in a financial hardship situation include:

- in any case – a letter of verification by a relevant independent third party with knowledge of the facts e.g. accountant, financial counsellor, social worker, lawyer, doctor, employer, family member (as applicable in the circumstances);

- in the case of illness – a medical certificate;

- in the case of unemployment – evidence that you have become unemployed or a relevant Centrelink benefits statement;

- in the case of low or insufficient income – a relevant Centrelink benefits statement;

- in a case where we reasonably believe there is a possibility of fraud – a statutory declaration of verification.

- Evidence that we request from you under this step 4 counts as part of your application, and your application is not complete until it has been provided to us.

16 Step 5: We’ll assess your eligibility for financial hardship assistance

- We’ll assess the information supplied in your application form and including evidence you supply, and determine your eligibility for financial hardship assistance.

- If it becomes clear to us that you are not eligible, we’ll tell you immediately.

- Otherwise:

- we’ll complete the assessment a.s.a.p. and no more than five business days after we receive your complete application; and

- we’ll tell you of the outcome of the assessment a.s.a.p and no more than two business days after we complete the assessment.

- If you are assessed as eligible, we’ll offer you financial hardship assistance

Offering assistance

17 Step 6: We’ll let you know if we need any further information (including documents)

- We’ll only do this where it’s reasonably necessary in order for us to consider what financial assistance is realistic, appropriate and suitable for your needs and situation.

- You can help us shortcut this step by providing helpful information in Part 3 of the application form, about what you can do to help you get your payments up to date. For instance, if you feel that you can afford to pay off arrears at $20 a week, tell us that.

- As far as possible, we’ll combine this step with step 5 i.e. we’ll make a single request for information.

18 Step 7: We’ll make you an offer

- If we ask for information under step 6, we’ll make you an offer of a financial hardship assistance arrangement no more than seven business days after we receive that information.

- Otherwise, we’ll make you an offer no more than seven business days after we notify you of the outcome of your eligibility assessment under step 5.

- Our offer will be in writing and sent to your preferred email address.

19 Step 8: Finalising a financial hardship assistance arrangement

- For the purposes of this step, our contact points are:

- post to IPSTAR Australia, 154 Pacific Highway, St Leonards, New South Wales 2065;

- email to [email protected];

- phone to 1300 464 778.

- You can choose to agree to our offer or to negotiate about it.

- You can notify your agreement through any of our contact points.

- You can also negotiate about it and agree another arrangement through any of our contact points.

- A financial hardship assistance arrangement starts as soon as you tell us that you agree to it.

- No more than two business days after a financial hardship assistance arrangement is agreed, we’ll send you written details of it.

Monitoring the progress of your application

20 Contact points

For the purposes of monitoring the progress of an application, our contact points are:

- post to Orion Satellite Systems, Level 2, 16 Victoria Avenue, Perth WA 6000;

- email to [email protected];

- phone to 1300 880 663.

21 Monitoring

You can monitor the progress of your application through any of the contact points.